WHAT IS CLEAN SURPLUS?

Clean Surplus is a little known accounting method designed to provide predictability for the investor. It is an extremely accurate method that allows us to compare the operating efficiency of each and every company in the exact same manner.

The traditional accounting statements do not develop the book value (Owners’ Equity) in the same manner for any two companies. Clean Surplus does indeed allow the exact, identical development of book value (Owners’ Equity) for each and every company. Thus, the efficiency ratio, Return on Equity developed by Clean Surplus and only Clean Surplus can be used as a true, comparable equivalent.

The accounting profession was aware that the traditional income statement didn’t provide for predictability and neither did the balance sheet. This is why Clean Surplus was developed. The problem is Clean Surplus has never been tested until now, and thus has not been used except by a very few, extremely successful people such as Warren Buffett.

The diminutive amount of research work on Clean Surplus prior to Dr. Belmonte’s research attempts to use Clean Surplus as a discounting valuation model. However, as with all discounting valuation models, we know by the failure of 96% of money managers (public mutual funds) to consistently outperform the averages over a 10-year time period, that these models just don’t work very well.

Buffett uses Clean Surplus to develop a Clean Surplus Return on Equity (ROE) rather than using the traditional accounting ROE as a comparison ratio in order to assess the consistency of the operating efficiency of a company and also the level of that operating efficiency.

Dr. Belmonte uses the Clean Surplus ROE to construct portfolios “predicted” to consistently outperform the market averages. Dr. Belmonte statistically measures the effectiveness of predictability using Clean Surplus over the past 15 years and finds that no other research and/or practical application can approach the success that he finds with the application of Clean Surplus.

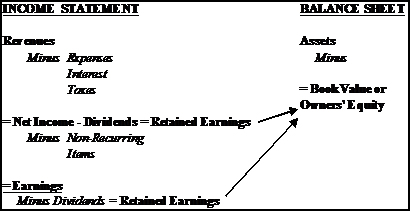

Traditional accounting constructs the ROE by using Earnings from the income statement divided by Book Value (Owners’ Equity) from the accounting balance sheet. See the bottom arrow on the following chart.

Traditional accounting constructs the ROE by using Earnings from the income statement divided by Book Value (Owners’ Equity) from the accounting balance sheet. See the bottom arrow on the following chart.

Clean Surplus instead uses Net Income from operations as the “Return” portion of the ROE and then constructs its own Owners’ Equity as the “Equity” portion of ROE. This is the top arrow on the above chart.

Of course, Net Income minus Dividends (top arrow) will net a different Owners’ Equity than will Earnings minus Dividends. It is this new calculation of Owners’ Equity (Net Income minus Dividends) that allows a truly comparable Return on Equity ratio to be developed. And it is this comparable Return on Equity ratio that is the foundation of the success of Clean Surplus.

Clean Surplus allows a true comparison of ROE (operating efficiency) from one company to another while traditional accounting does not allow for good or even mediocre comparability.

Dr. Belmonte’s research attempts to statistically answer two questions:

1) Do portfolios with above average Clean Surplus ROEs outperform the market averages and 2) Does the Clean Surplus ROE (the percentage number) have any correlation with the future returns of portfolios?

The results of the research show that indeed, the answers to both questions are yes. Not only do every one of the portfolios predicted to outperform the averages do so, but there is a strong correlation as to how much those portfolios will return. Correlations of ROE and the future total returns with portfolios of 30 stocks averaged consistently between 79% to 80%.